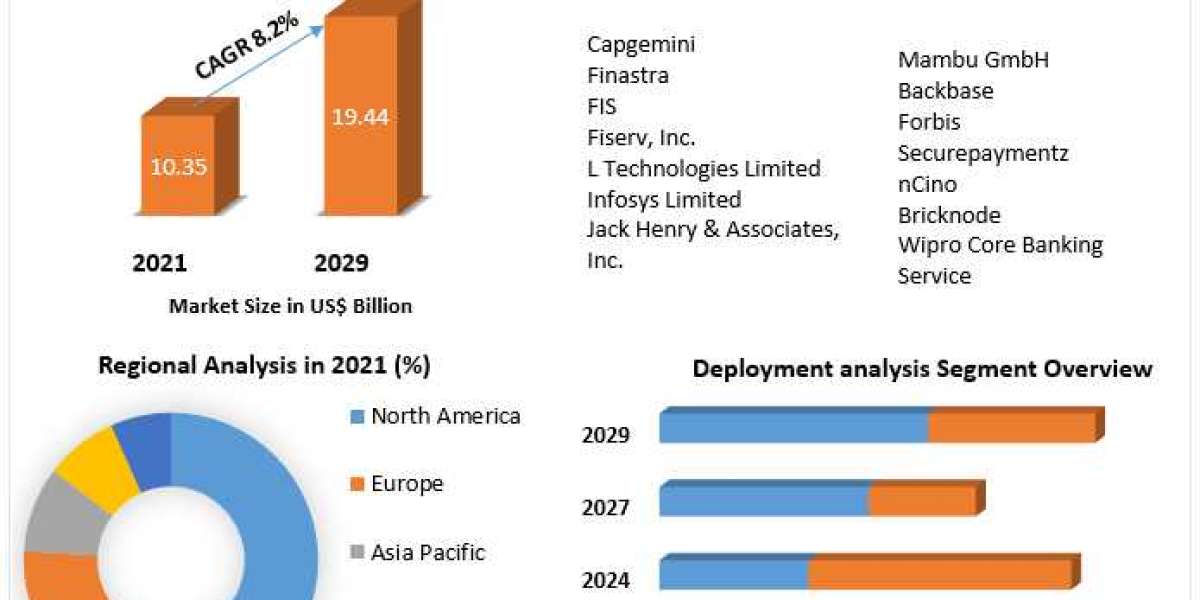

Core Banking Software Market Overview :

This Core Banking Software market report covers new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographies, and product approvals, product launches. To learn more about Maximize Market Research window sensors market, please contact us for an Analyst Brief; our experts will assist you in making an informed market choice to achieve your goals.

Core Banking Software Market Scope :

The competitive landscape for the Core Banking Software market gives information by a competitor. Corporate overview, financials, revenue produced, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application domination are all contained in the details. The data points shown above are only linked to the firms' concentration on the window sensors industry.

Core Banking Software Market Dynamics:

The worldwide Core Banking Software market's growth reasons, as well as the market's many users, are discussed. Data is provided by market participants, regions, and specific requirements. This market-ready study proposal includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis should be presented in the form of statistics, infographics, and presentations.

The study discusses the Core Banking Software market's Drivers, Restraints, Opportunities, and Challenges. The research assists in identifying the market growth drivers and determining how to leverage these factors as strengths. The research assists in identifying issues and solutions based on the market condition.

Request for free broacher: https://www.maximizemarketresearch.com/request-sample/148072

COVID-19 Impact Analysis of Core Banking Software market:

The COVID-19 pandemic caused a significant and extended drop in production utilization, and travel prohibitions and facility closures have kept personnel away from their facilities, causing the Core Banking Software market to decelerate in 2020. The new report includes insights, analyses, estimates, and predictions that include the influence of COVID 19 on the Core Banking Software market. Maximize Core Banking Software Market Research report includes an in-depth analysis of consumer behavior in the wake of the pandemic as well as its impact on the future of the Core Banking Software market along with the impact on segmentation, drivers, and increase in market restraints.

Regional Analysis :

Regional Insights in our studies guarantee that you are well-informed on the Core Banking Software industry on a regional level. Region-wise, we have done a wide range of high-resolution regional investigations. Global Core Banking Software Market research provides exact knowledge that enables market participants to compete successfully with their greatest competitors based on growth, sales, and other crucial aspects. The region portion of the research also provides key market influencing aspects and changes in market regulation that impact the market's current and future trends.

Segmentation:

The market is divided into licenced and SaaS/hosted products based on the results of the deployment analysis. The majority of this SaaS/hosted deployment's market share belongs to the core banking software. The change is a result of growing demand for cloud-based financial systems. These solutions would aid the client in expanding their financial operations, such as computing interest, modifying credits, and managing withdrawals and deposits.

Due to the growing acceptance of licensed-based financial solutions for lower operating and security costs, the licenced segment is anticipated to experience revolutionary growth. Customers are concentrating on using different licenced financial engines to conduct financial transactions without the need for installment fees. For instance, Finacle, a licenced central financial programming tool offered by Infosys, provides many banks with global computerised banking functionality.

To remain ‘ahead’ of your competitors, request for a sample : @ https://www.maximizemarketresearch.com/request-sample/148072

Key Players:

The study gives a complete assessment of the current Core Banking Software market players in various areas and countries. A thorough country-wise assessment of the industry players has been included in the report. The worldwide Core Banking Software Market research report provides a thorough analysis that is bound to help market players to compete successfully with their competitors based on growth, sales, shares, dynamics other critical factors.

• Capgemini

• Finastra

• FIS

• Fiserv, Inc.

• L Technologies Limited

• Infosys Limited

• Jack Henry Associates, Inc.

• Oracle Corporation

• Temenos Group

• UnisysSAP SE

• TATA Consultancy Services

• Capital Banking Solutions

• EdgeVerve System Limited

• Fidelity National Information Services

• Mambu GmbH

• Backbase

• Forbis

• Securepaymentz

• nCino

• Bricknode

• Wipro Core Banking Service

• C-Edge Technologies

Will You Have Any Questions About This Report? Please Contact Us On link : https://www.maximizemarketresearch.com/market-report/core-banking-software-market/148072/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

CONTACT MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT Park Phase 2,

Pune Banglore Highway,

Narhe, Pune, Maharashtra 411041, India.

Email: sales@maximizemarketresearch.com

Phone No.: +91 20 6630 3320

Website: www.maximizemarketresearch.com