Understudy loans are a significant asset for funding instruction, and credit applications have arisen as a helpful device to smooth out the getting system. This complete aide investigates the advantages and functionalities of credit applications planned explicitly for understudies. Find how these applications give simple admittance to monetary help, work on the application cycle, and enable understudies in their instructive interests.

The Significance of Educational Loan Applications

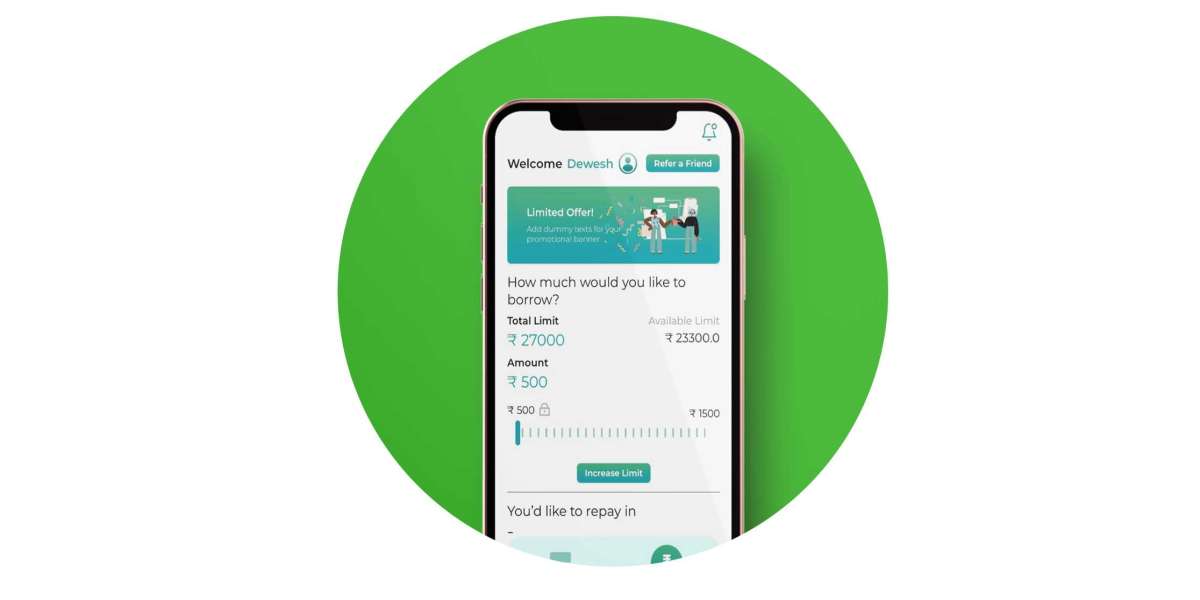

Understudy loan UrbanMoney have changed the manner in which understudies access and deal with their monetary help. These applications offer an easy to understand stage that works on the credit application process, gives helpful admittance to credit data, and empowers consistent correspondence with moneylenders. By utilizing the force of innovation, understudy loan applications enable understudies to pursue informed acquiring choices, deal with their advances successfully, and center around their scholastic process without superfluous monetary pressure.

Advantageous Credit Application Cycle

Understudy loan applications smooth out the credit application process, hurrying up and bother free. These applications permit understudies to finish applications carefully, disposing of the requirement for desk work and significant delays. They give natural connection points and bit by bit direction, guaranteeing understudies give all fundamental data precisely. Moreover, credit applications frequently offer pre-capability instruments that gauge qualification and potential advance sums, providing understudies with a reasonable comprehension of their getting limit prior to applying.

Constant Credit Data and Updates

Credit applications keep understudies informed about their advance status, reimbursement terms, and any progressions or updates. Understudies can undoubtedly get to credit subtleties, including loan fees, reimbursement timetables, and record adjusts, through a protected and easy to use dashboard. Continuous warnings and cautions assist understudies with keeping steady over significant credit achievements, guaranteeing they never miss an installment or basic cutoff time. By giving straightforward and exceptional data, credit applications engage understudies to capably deal with their funds.

Customized Monetary Administration

Numerous understudy loan applications offer extra monetary administration highlights to help understudies spending plan and plan their costs really. These elements might incorporate cost following, planning devices, and credit number crunchers that permit understudies to assess reimbursement choices and figure out the effect of their acquiring choices. With customized monetary bits of knowledge and direction, understudies can settle on informed decisions, limit obligation trouble, and foster sound monetary propensities that will help them past their scholarly years.

Upgraded Client service and Help

Advance applications regularly give hearty client assistance channels, including visit backing, FAQs, and direct contact with credit trained professionals. Understudies can look for help, seek clarification on some pressing issues, and resolve any worries they might have about their credits or the application cycle. This brief and open help guarantees understudies have a positive and peaceful experience, realizing they have a dependable asset to go to for direction and help at whatever point required.

End

Credit applications for understudies have changed the manner in which understudies access and deal with their monetary help. By offering a helpful and straightforward getting experience, these applications engage understudies to explore the credit cycle with certainty. Embrace the advantages of credit applications to smooth out your acquiring process and spotlight on your instructive yearnings with monetary genuine serenity.

For more information, Visit us:-