Introduction: Facing unemployment can be a challenging and stressful experience, often accompanied by financial uncertainty. For those without a steady income, the option of payday loans may seem like a lifeline. This article explores the dynamics of payday loans for the unemployed, offering insights into their implications and providing essential information for individuals navigating this financial terrain. https://vartojimo-paskola.lt/

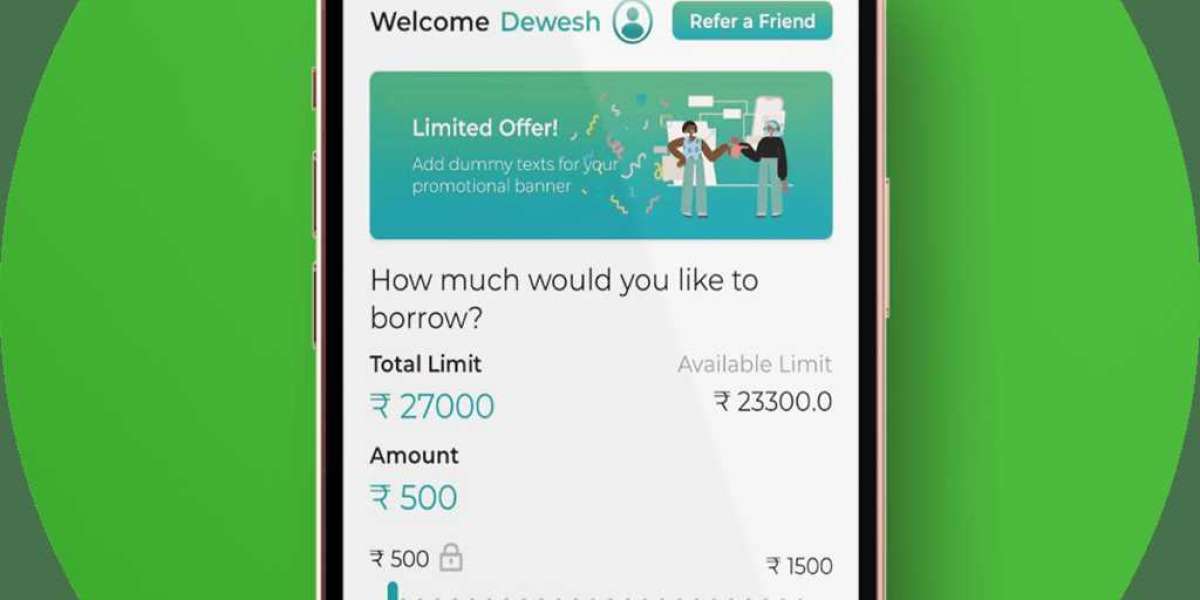

Access to Quick Cash During Unemployment: Payday loans are accessible to individuals without a job, providing a quick source of cash during periods of unemployment. However, the ease of access comes with its own set of considerations.

Limited Eligibility and Higher Interest Rates: Payday lenders may have specific eligibility criteria for unemployed individuals, and interest rates can be higher than those for employed borrowers. It's crucial to understand the terms and conditions before committing to a payday loan.

Ability to Repay: Unemployed individuals must carefully assess their ability to repay a payday loan. Considering the absence of a regular income, a realistic repayment plan should be in place to avoid falling into a cycle of debt.

Exploring Alternative Options: Before turning to payday loans, unemployed individuals should explore alternative options. This may include seeking financial assistance from friends or family, exploring government assistance programs, or looking into community-based resources.

Understanding Loan Terms: Thoroughly understanding the terms of the payday loan is essential. Pay attention to the repayment period, interest rates, and any additional fees. Transparent communication with the lender is crucial to avoid unexpected surprises.

Impact on Credit Score: While payday loans typically do not require a credit check, the repayment history can impact credit scores. Unemployed individuals should be aware of the potential consequences on their creditworthiness.

Risk of Debt Cycle: The short-term nature of payday loans can pose a risk of falling into a debt cycle, especially for those without a regular income. Borrowers should assess their financial situation and plan for repayment accordingly.

Financial Counseling and Education: Seeking financial counseling during unemployment can provide valuable insights. Professionals can offer guidance on managing expenses, creating a budget, and exploring options beyond payday loans.

Emergency Fund Consideration: Building and maintaining an emergency fund, even during periods of employment, can serve as a financial safety net. This fund can help cover expenses without relying solely on high-cost payday loans.

Legal Protections: Research the legal protections in place for borrowers in your jurisdiction. Some regions have regulations to prevent predatory lending practices and ensure fair treatment of individuals seeking payday loans.

Conclusion: While payday loans may offer a temporary solution for the unemployed, careful consideration of the terms, alternative options, and long-term financial planning is essential. Navigating unemployment requires a holistic approach that prioritizes financial well-being and minimizes the risks associated with high-interest, short-term loans.