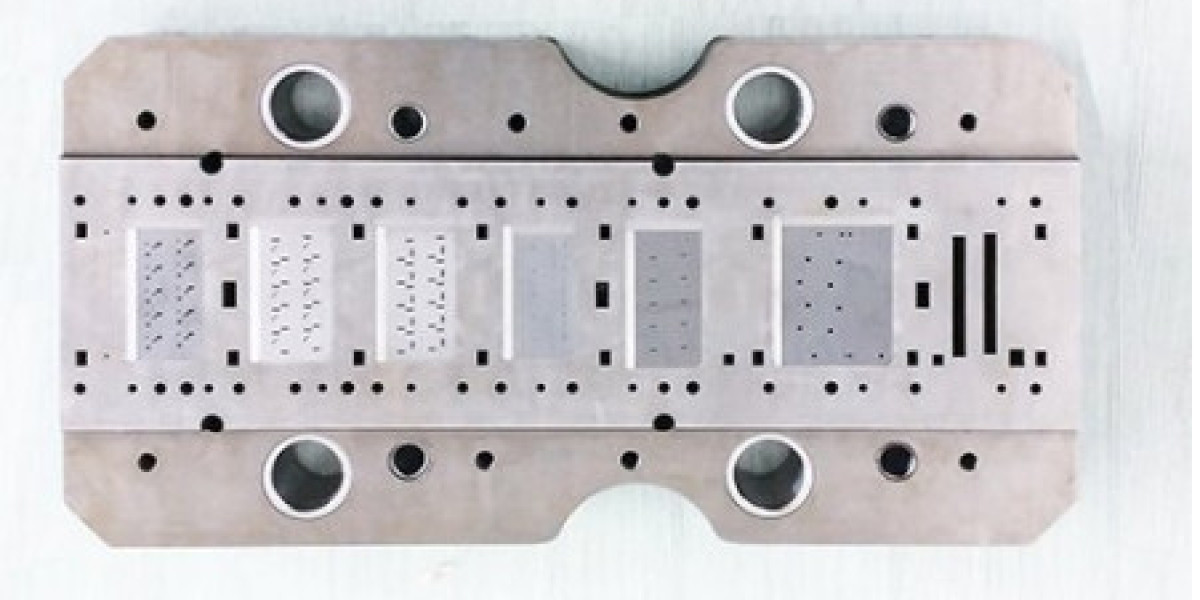

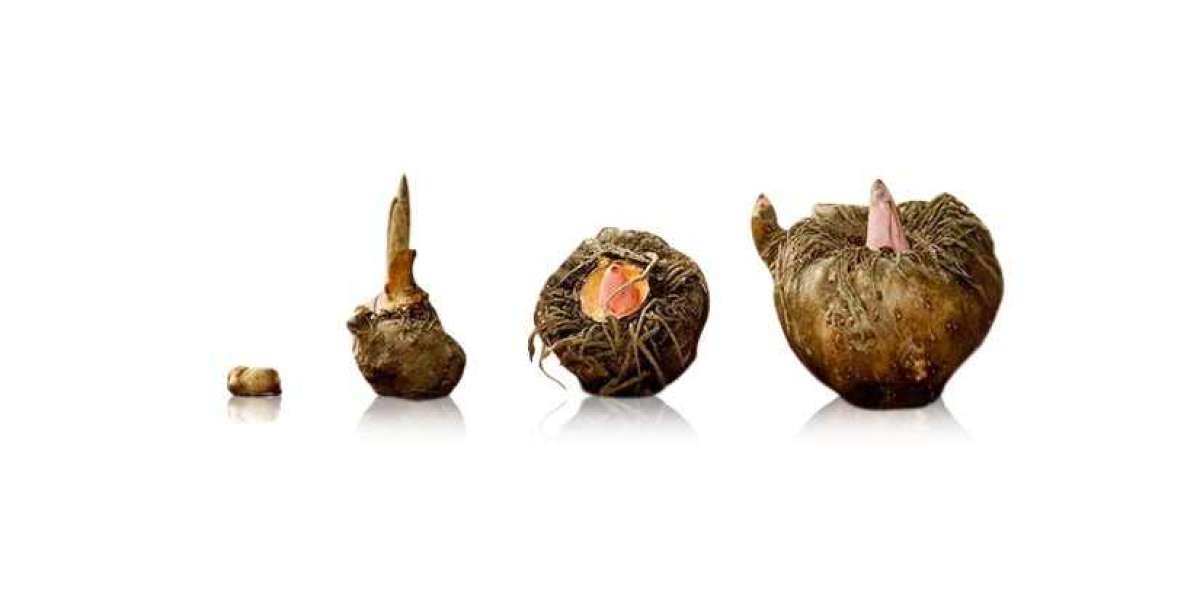

The growing use of stud welding in lightweight building materials like aluminum and composites is a smart adaptation to industry developments. Lighter structures are required in industries such as automotive and aircraft to increase fuel efficiency and performance.

Manufacturers of stud welding equipment are adjusting their technology to connect these materials effectively, fulfilling the special demands of industries emphasizing weight reduction without sacrificing structural integrity.

The rise of prefabrication and modular building approaches is impacting the stud welding business. Stud welding is essential for successfully attaching prefabricated components, contributing to speedier building processes and lower costs. The growth is consistent with the increasing need for modular solutions in a variety of industries, including construction, where efficiency and precision are essential concerns.

Request a Report Sample to Gain Comprehensive Insights:

https://www.futuremarketinsights.com/reports/sample/rep-gb-18395

Manufacturers of stud welding equipment are responding to the wave of Industry 4.0 by incorporating automation and data-driven technology into their systems. This entails refining welding procedures overall, allowing predictive maintenance, and integrating IoT sensors for real-time monitoring and control.

The transition to Industry 4.0 aligns with the larger industrial trend of smart manufacturing, in which data analytics and networking improve operational effectiveness, reduce downtime, and foster a more responsive and flexible production environment.

Key Takeaways from the Stud Welding Equipment Market Report

- In 2023, the global market size stood at US$ 1,081.20 million.

- The arc stud welder segment occupied 00% of the market by product type in 2024.

- The metal fabrication segment captured 00% of the market by end use in 2024.

- The market in the United States is projected to rise at a 50% CAGR through 2034.

- The market in Germany is anticipated to develop at a 30% CAGR through 2034.

- The market in China is estimated to surge at a 40% CAGR through 2034.

- The market in India is expected to thrive at a 60% CAGR through 2034.

Request the Full Report Methodology Now:

https://www.futuremarketinsights.com/request-report-methodology/rep-gb-18395

Competitive Landscape

The market for stud welding equipment is highly competitive, with a mix of fresh entrants who provide innovation and agility and more established competitors who leverage their market position and expertise.

The industry’s future course is likely to be influenced by its ongoing quest for technical innovation, strategic alliances, and astute market positioning in order to satisfy the changing needs of various industrial sectors around the globe.

Key Players in the Stud Welding Equipment Market

- Nelson Stud Welding (Doncasters Group)

- Taylor Studwelding Systems Ltd.

- HBS Stud Weldings

- Soyer Group (ARO Technologies Inc.)

- KÖCO – Kohlhoff & Co. GmbH

- Tru-Weld Stud Welding

- Stanley Engineered Fastening (STANLEY® Engineered Fastening brands: Nelson Fastener Systems, Tucker Stud Welding, Spiralock)

- Heinz Soyer Bolzenschweißtechnik GmbH

- Image Industries

- Image Industries GmbH & Co. KG

Stud Welding Equipment Market Segmentation

By Product Type:

- Capacitor Discharge Stud Welder

- Short Cycle/Drawn – Arc Stud Welder

By Operation:

- Automatic

- Semi-automatic

By Stud Range:

- Below 3 mm

- 3 to 12 mm

- 12 to 18 mm

- 18 mm & Above

By End Use/End-use Industry:

- Automotive

- Construction

- Metal Fabrication

- Decorative and Consumer Item

- Electric Item

- Furniture

- Shipbuilding

- Others

By Region:

- North America

- Latin America

- Western Europe

- Eastern Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- Japan