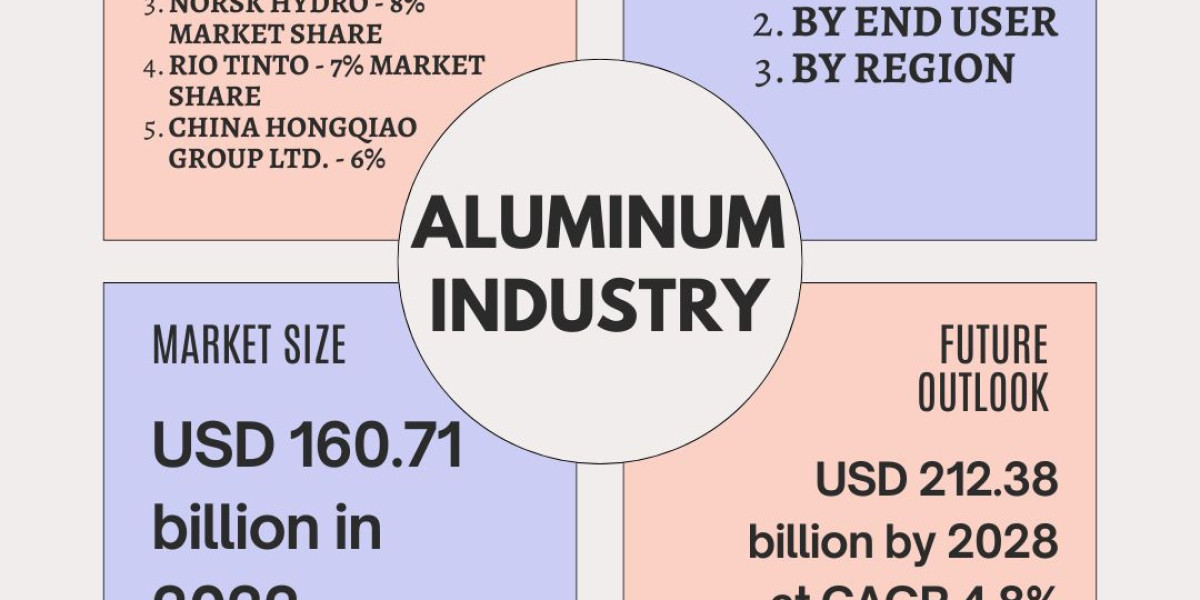

The aluminum market is a significant sector in the global metals industry, the global aluminum market size was valued at USD 170.7 billion in 2022 and is expected to grow to USD 256.53 billion by 2031, at a CAGR of 5.2% from 2024 to 2031.

The market is driven by the increasing demand for lightweight and energy-efficient materials in various industries such as transportation, construction, and packaging.

Aluminum Market Segmentation

The aluminum market is segmented based on product, application, end-user, and region. The key segments include:

1. Product Type:

Primary aluminum: This type of aluminum is used in manufacturing products such as drawn tube, chemical equipment, sheets, plates, foil, and metal tableware.

Secondary aluminum: This type of aluminum is used in manufacturing products such as extrusions, castings, and forgings. The aluminum casting market is growing fast.

Flat Rolled aluminum: This type of aluminum is used in manufacturing products such as sheets, plates, and foil.

Castings aluminum: This type of aluminum is used in manufacturing products such as engine blocks, cylinder heads, and gearboxes.

Extrusions aluminum: This type of aluminum is used in manufacturing products such as window frames, door frames, and structural components.

Rod & Bar aluminum: This type of aluminum is used in manufacturing products such as rods, bars, and wire.

Forgings aluminum: This type of aluminum is used in manufacturing products such as engine components, gearboxes, and other structural components.

2. Application:

Building & Construction: This segment includes the use of aluminum in building materials such as windows, doors, and roofing.

Automotive & Transportation: This segment includes the use of aluminum in automotive components such as engine blocks, cylinder heads, and gearboxes.

Foil & Packaging: This segment includes the use of aluminum in packaging materials such as cans, foil, and other containers.

Power: This segment includes the use of aluminum in power generation and transmission equipment such as transformers and generators.

Machinery & Equipment: This segment includes the use of aluminum in machinery and equipment such as pumps, valves, and other industrial components.

Consumer Goods: This segment includes the use of aluminum in consumer goods such as cookware, cutlery, and other household items.

3. End-User Industry:

Transport: This segment includes the use of aluminum in the transportation industry, including automotive and aerospace applications.

Building & Construction: This segment includes the use of aluminum in building materials and construction projects.

Electrical Engineering: This segment includes the use of aluminum in electrical engineering applications such as transformers and generators.

Consumer Goods: This segment includes the use of aluminum in consumer goods such as cookware, cutlery, and other household items.

Foil & Packaging: This segment includes the use of aluminum in packaging materials such as cans, foil, and other containers.

Machinery & Equipment: This segment includes the use of aluminum in machinery and equipment such as pumps, valves, and other industrial components.

4. Region:

North America: This region includes the United States, Canada, and Mexico.

Europe: This region includes the United Kingdom, Germany, France, and other European countries.

Asia-Pacific: This region includes China, Japan, India, and other Asian countries.

Latin America: This region includes Brazil, Mexico, and other Latin American countries.

Middle East & Africa: This region includes countries such as Saudi Arabia, United Arab Emirates, and South Africa.

These segments help to identify the prevailing market opportunities and challenges in the aluminum industry.

Key Players and their market share in aluminum Industry

The top players in the aluminum market include:

UC Rusal - 12% market share

Alcoa - 10% market share

Norsk Hydro - 8% market share

Rio Tinto - 7% market share

China Hongqiao Group Ltd. - 6% market share

Case Study: UC Rusal

UC Rusal is a Russian multinational aluminum producer that is the world's second-largest aluminum producer. The company was founded in 2007 and is headquartered in Moscow, Russia. UC Rusal operates in 12 countries and has a significant global footprint, with a strong presence in Europe, Asia, and the Americas.

History and Background

UC Rusal was founded in 2007 through the merger of two Russian aluminum companies, Rusal and SUAL. The company's history dates back to the 1970s, when Rusal was established as a state-owned aluminum producer. In the 1990s, the company underwent significant changes, including privatization and restructuring. In 2007, Rusal and SUAL merged to form UC Rusal, which has since become one of the world's largest aluminum producers.

Operations

UC Rusal operates a diverse range of aluminum production facilities, including smelters, refineries, and rolling mills. The company's operations are spread across 12 countries, including Russia, Ireland, Australia, and the United States. UC Rusal's production capacity is over 3.5 million metric tons per year, making it the world's second-largest aluminum producer.

Products and Services

UC Rusal produces a wide range of aluminum products, including primary aluminum, aluminum foil, and aluminum extrusions. The company's products are used in various industries, including transportation, construction, packaging, and consumer goods.

Sustainability and Environmental Impact

UC Rusal has made significant efforts to reduce its environmental impact and improve its sustainability. The company has implemented various initiatives, including the use of renewable energy sources, waste reduction programs, and recycling programs. UC Rusal has also developed a sustainable aluminum brand, ALLOW, which is designed to promote the company's low-carbon aluminum products.

Statistics

Production Capacity: Over 3.5 million metric tons per year

Global Footprint: Operates in 12 countries

Employees: Over 60,000 employees worldwide

Revenue: Over USD 10 billion per year

Market Share: 12% of global aluminum market

Sustainability Initiatives: Implemented various sustainability initiatives, including the use of renewable energy sources, waste reduction programs, and recycling programs

ALLOW Brand: Developed a sustainable aluminum brand, ALLOW, which promotes low-carbon aluminum products

Conclusion

The aluminum market outlook is a significant sector in the global metals industry, driven by the increasing demand for lightweight and energy-efficient materials. The top players in the market, including UC Rusal, Chalco, Alcoa, Rio Tinto, and Norsk Hydro, have a significant global presence and diversified product portfolios. However, the market faces challenges such as dependence on raw materials, environmental concerns, and competition from substitutes.