In today’s fast-paced digital world, financial services are evolving rapidly to meet the demands of tech-savvy consumers. UrbanMoney stands out as a pioneering platform that merges traditional financial services with cutting-edge technology, providing users with an unparalleled experience in managing their finances. This article explores how UrbanMoney is transforming the landscape of financial services, its key features, and the benefits it offers to its users.

What is UrbanMoney?

UrbanMoney is a comprehensive financial services platform designed to cater to the diverse financial needs of urban consumers. By leveraging advanced technology, UrbanMoney offers a seamless and efficient way to manage personal finances, investments, loans, and more. It aims to simplify financial management, making it accessible and convenient for everyone, from young professionals to seasoned investors.

Key Features of UrbanMoney

Personal Finance Management

Expense Tracking: Automatically categorizes and tracks your expenses, helping you stay on top of your spending habits.

Budgeting Tools: Create and manage budgets to ensure you’re meeting your financial goals.

Financial Insights: Provides detailed reports and insights into your financial health.

Investment Services

Portfolio Management: Allows users to manage their investment portfolios with ease.

Robo-Advisors: Automated investment advice based on your financial goals and risk tolerance.

Market Analysis: Real-time data and analytics to help make informed investment decisions.

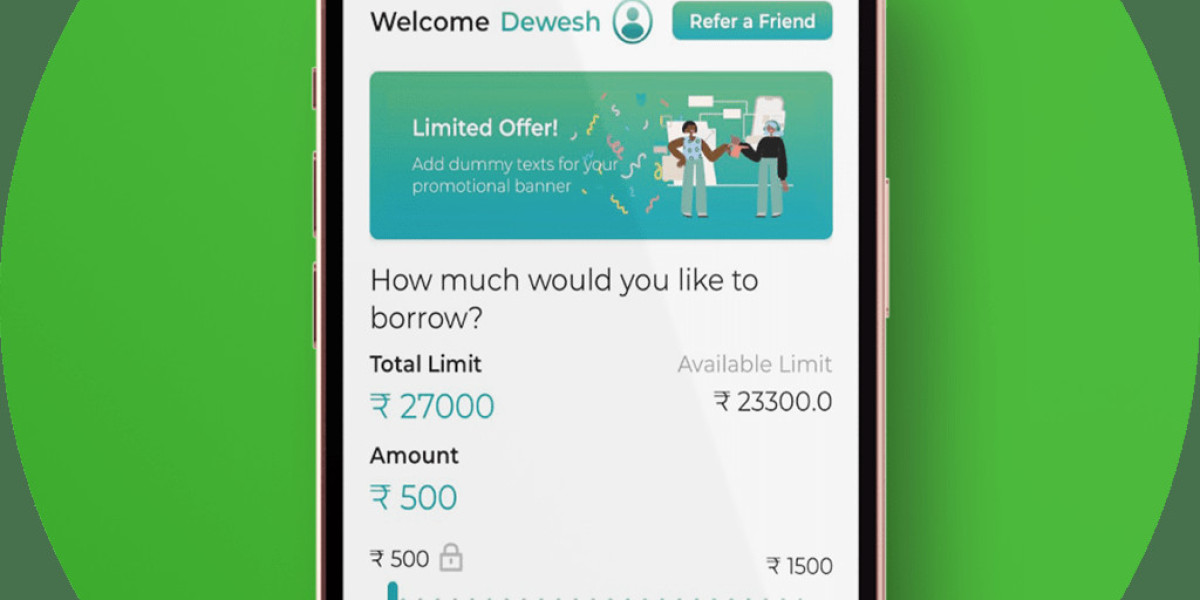

Loan Services

Loan Comparison: Compare loan offers from various lenders to find the best rates and terms.

Application Assistance: Streamlined loan application process with support from financial experts.

Credit Score Monitoring: Keep track of your credit score and receive tips to improve it.

Savings and Deposits

High-Interest Savings Accounts: Offers competitive interest rates to maximize your savings.

Fixed Deposits: Provides secure investment options with attractive returns.

Recurring Deposits: Allows you to save a fixed amount regularly and earn interest.

Insurance Services

Policy Comparison: Compare insurance policies to find the best coverage at affordable rates.

Easy Claims: Simplified claims process with support from dedicated agents.

Comprehensive Coverage: Offers a range of insurance products including health, life, and vehicle insurance.

Benefits of Using UrbanMoney

Convenience and Accessibility

Access all your financial services from a single platform, available 24/7 via mobile and web applications.

Simplifies complex financial tasks, making it easy for users to manage their finances on-the-go.

Personalized Financial Solutions

Tailors financial advice and services based on individual user profiles and goals.

Uses data-driven insights to provide personalized recommendations.

Enhanced Financial Security

Employs advanced security measures to protect user data and transactions.

Regularly updates security protocols to guard against emerging threats.

Cost-Effective

Offers competitive rates and low fees compared to traditional financial services.

Provides tools to help users save money and make the most of their financial resources.

Expert Support

Access to financial experts who can provide guidance and support for complex financial decisions.

Regular updates and educational resources to help users stay informed about financial trends and opportunities.

The Future of Financial Services with UrbanMoney

As the financial landscape continues to evolve, UrbanMoney is poised to lead the way in integrating technology with financial services. The platform is continuously innovating, incorporating artificial intelligence, machine learning, and blockchain technology to enhance its offerings. Future developments may include more advanced robo-advisors, expanded cryptocurrency services, and deeper integration with other financial technologies.

Conclusion

UrbanMoney is transforming how urban consumers interact with financial services. By offering a comprehensive, user-friendly platform that combines personal finance management, investment services, loans, savings, and insurance, UrbanMoney is making financial management more accessible, efficient, and secure. Whether you’re looking to save money, invest wisely, or simply manage your day-to-day finances, UrbanMoney provides the tools and support you need to achieve your financial goals.

For more info. Visit us: